Investment Analysis and Portfolio Management | 6th Edition | Prasanna Chandra

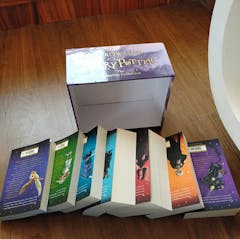

Condition :Like new (slightly imperfect)

This book provides clear and practical insights into mastering the principles of investment management. Drawing on the groundbreaking research of Nobel Laureates and investment pioneers, it equips readers with the tools to analyze, value, and manage investments effectively. Designed for MBA students, investment practitioners, and lay investors, the book blends academic insights with practical strategies to help navigate the complexities of modern financial markets.

✨ Salient Features

- ✔️ Explains risk-return frameworks and portfolio management

- ✔️ Covers valuation techniques for stocks, bonds, and derivatives

- ✔️ Discusses behavioral finance and market efficiency

- ✔️ Provides actionable investment guidelines

🌐 Web Supplements

- 📊 PowerPoint Presentations

- 📘 Solutions Manual

- 🛠️ Custom

- 🧠 Quiz

- 📈 Exhibits

- 📝 Problems and Mini Cases

- ✔️ Solved Problems

- 💡 Test Bank

- 🌐 Online Appendices

📑 Table of Contents

Part 1: Introduction

- 1️⃣ Overview: A Broad Map of the Territory

- 2️⃣ Investment Alternatives: Choices Galore

- 3️⃣ Financial Markets: The Link between Savers and Investors

Part 2: Basic Concepts and Methods

- 5️⃣ Risk and Return: Two Sides of the Investment Coin

- 6️⃣ The Time Value of Money: The Magic of Compounding

Part 3: Modern Portfolio Theory

- 7️⃣ Portfolio Theory: The Benefits of Diversification

- 8️⃣ Capital Asset Pricing Model and Arbitrage Pricing Theory: The Risk Reward Relationship

- 9️⃣ Efficient Market Hypothesis: The Collective Wisdom

- 🔟 Behavioral Finance: The Irrational Influences

Part 4: Fixed Income Securities

- 11️⃣ Bond Prices and Yields: Figuring out the Assured Returns

- 12️⃣ Bond Portfolio Management: The Passive and Active Stances

Part 5: Equity Shares

- 13️⃣ Equity Valuation: How to Find Your Bearings

- 14️⃣ Macroeconomic and Industry Analysis: Understanding the Broad Picture

- 15️⃣ Company Analysis: Establishing the Value Benchmark

- 16️⃣ Technical Analysis: The Visual Clue

Part 6: Derivatives

- 17️⃣ Options: The Upside Without the Downside

- 18️⃣ Futures: Where the Hedgers and the Speculators Meet

Part 7: Other Investment Options

- 19️⃣ Mutual Funds and Alternative Investment Funds: Indirect Investing

- 20️⃣ Investment in Real Assets: The Tangible Thing

- 21️⃣ International Investing: The Global Search

Part 8: Portfolio Management

- 22️⃣ Investment Policy and Strategy: The Grand Design

- 23️⃣ Implementation and Review—The Specific Moves

Part 9: Professional and Institutional Money Management

- 24️⃣ Seeking the Help of Experts

Part 10: Key Guidelines and Strategies of the Great Masters

- 25️⃣ Key Guidelines for Investment Decisions: What It All Comes To

- 26️⃣ Strategies of the Great Masters: The Timeless Wisdom